Som mange kanskje har fått med seg så har Urmaker Thorbjørnsen salg av diverse klokker på Facebook, blant annet et par modeller fra Staudt. Det ser ut som veldig fine klokker, men har ingen kjennskap til merket. Er det noen her som har erfaringer med merket?

Klokkecafé – løst og fast om klokker

- Trådstarter jsf

- Opprettet

Du bruker en utdatert nettleser. Det kan ikke vise dette eller andre nettsteder på riktig måte.

Du bør oppgradere eller bruke en alternativ nettleser.

Du bør oppgradere eller bruke en alternativ nettleser.

Oddemann

Støttemedlem

Ikkje anna enn lest om desse i artikkelen til @Jon Henrik . Han har kanskje meir å tilføye?Som mange kanskje har fått med seg så har Urmaker Thorbjørnsen salg av diverse klokker på Facebook, blant annet et par modeller fra Staudt. Det ser ut som veldig fine klokker, men har ingen kjennskap til merket. Er det noen her som har erfaringer med merket?

Staudt Watches lanseres i Norge

Urmaker Thorbjørnsen henter nederlandske Staudt Watches til Norge.

www.tidssonen.no

www.tidssonen.no

Enig. De ser veldig fine ut, og prisen er heller ikke noe å klage på.Staudt sett jo meget lovende ut.

Artig at noen prøver seg. Dette ser finere ut enn enkelte andre "nyprodusenter". Når de også er på tilbud frister det ekstra.

Spennende!

8

Interessant:

Shares of Swiss watchmaker Swatch – owner of Balmain and Omega – ticked up 6% on Wednesday. Its profit for the last six months fell 11% from last year, but that was a smaller drop than investors expected.

What Does This Mean?

Last month’s US retail sales grew faster than predicted, which may have worked in Swatch’s favor: the timepiece specialist has turned a brisk business Stateside this year. Looking east, meanwhile, Asia gaveth and Asia tooketh away. Sales in China and Japan rose, but recent protests in Hong Kong – the world’s biggest market for luxury Swiss watches – put off local shoppers and high-rolling tourists alike. Swatch’s sales there fell by more than 10% – leading to lower total revenue in the last six months than this time last year.

Why Should I Care?

For markets: Long-term greedy.

Another reason for Swatch’s sales decline was its recent crackdown on unauthorized resellers of its watches. The company has been cutting off their supply – which stops them from selling at large discounts – by buying back unsold stock from authorized dealers. That should mean Swatch can sell its watches at higher prices in the future. And since the cost of making watches won’t change, investors buying up Swatch’s shares may expect a higher future profit, all else being equal.

The bigger picture: Luxury’s eyeing up sustainability.

Luxury brands have a reputation for being slow to adapt – especially compared to their fast-fashion cousins – and that’s certainly been the case for retail’s transition to ecommerce. So you’d be forgiven for thinking luxury firms would be slow to pick up on consumers’ focus on sustainability, too. But on Monday, the world’s biggest luxury company LVMH (chaired by the world’s second-richest person) announced a tie-up with Beatle daughter/fashion brand Stella McCartney, known for her/its focus on sustainable and ethical luxury wares. LVMH may now find itself on the wishlists of investors keen on companies that put ethical practice center stage.

Shares of Swiss watchmaker Swatch – owner of Balmain and Omega – ticked up 6% on Wednesday. Its profit for the last six months fell 11% from last year, but that was a smaller drop than investors expected.

What Does This Mean?

Last month’s US retail sales grew faster than predicted, which may have worked in Swatch’s favor: the timepiece specialist has turned a brisk business Stateside this year. Looking east, meanwhile, Asia gaveth and Asia tooketh away. Sales in China and Japan rose, but recent protests in Hong Kong – the world’s biggest market for luxury Swiss watches – put off local shoppers and high-rolling tourists alike. Swatch’s sales there fell by more than 10% – leading to lower total revenue in the last six months than this time last year.

Why Should I Care?

For markets: Long-term greedy.

Another reason for Swatch’s sales decline was its recent crackdown on unauthorized resellers of its watches. The company has been cutting off their supply – which stops them from selling at large discounts – by buying back unsold stock from authorized dealers. That should mean Swatch can sell its watches at higher prices in the future. And since the cost of making watches won’t change, investors buying up Swatch’s shares may expect a higher future profit, all else being equal.

The bigger picture: Luxury’s eyeing up sustainability.

Luxury brands have a reputation for being slow to adapt – especially compared to their fast-fashion cousins – and that’s certainly been the case for retail’s transition to ecommerce. So you’d be forgiven for thinking luxury firms would be slow to pick up on consumers’ focus on sustainability, too. But on Monday, the world’s biggest luxury company LVMH (chaired by the world’s second-richest person) announced a tie-up with Beatle daughter/fashion brand Stella McCartney, known for her/its focus on sustainable and ethical luxury wares. LVMH may now find itself on the wishlists of investors keen on companies that put ethical practice center stage.

Ute på Moldivene og nyter sommerkvelden. Påhengsmotorer durer en del, og det fikk meg til å lure på om vibrasjonene kan skade urverket i klokka... Noen med formeninger?

chrbir

Støttemedlem

Noen som vurderer nye Yema Superman GMT? Alle versjonene er jo egt ganske kule, men naturligvis enig med artikkelforfatter i at grå/blå er mest unik. Lås på bezel gir vel ikke akkurat like mye mening på en GMT, men når det først er en Superman...

Vis vedlegg 154678

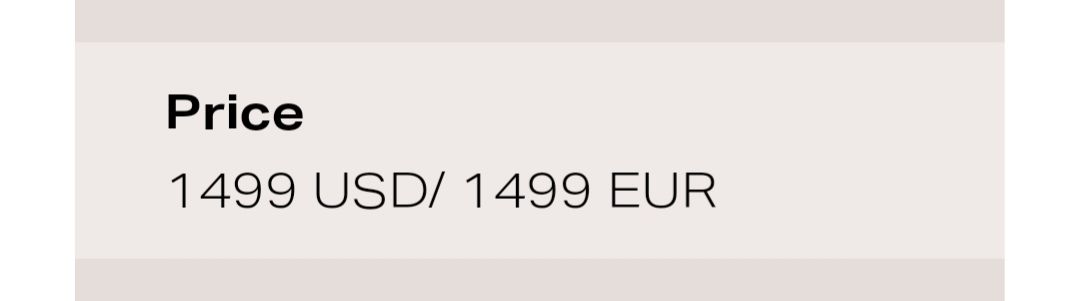

Kun 100 eks. av hver fargekombinasjon, forhåndsbestilling fra 22. juli, forventet levering i november, og pris er USD 1499.

Hot Take: The First Yema Superman GMT

Tomas talks about the Yema Superman GMT, a watch designed on the Yema CoLabs platform, based on feedback from Yema fans.www.fratellowatches.com

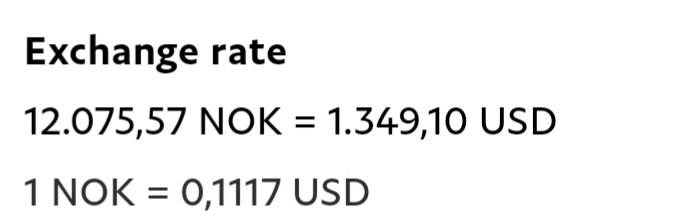

Jeg kjøpte en slik modell. Er det flere som har handlet? Tenker å spørre i hvilket valuta dere betalte? Jeg betalte i euro mens prisene er opplyst i usd på hjemmesiden. Da jeg påpekte dette ble jeg fortalt at ”As you are in Norway, the currency is in Euros”

Lurer bare på hvordan dere betalte? For 1349,10 euro er ikke samme som 1349,10 dollar.

Jeg kjøpte en slik modell. Er det flere som har handlet? Tenker å spørre i hvilket valuta dere betalte? Jeg betalte i euro mens prisene er opplyst i usd på hjemmesiden. Da jeg påpekte dette ble jeg fortalt at ”As you are in Norway, the currency is in Euros”

Lurer bare på hvordan dere betalte? For 1349,10 euro er ikke samme som 1349,10 dollar.

Ikke kjøpt, konkluderte med at det er noe annet som frister mer akkurat nå, men veldig kult at du har! Hvilken versjon gikk du for?

Høres ut som en snål praksis, men ser at prisen er oppgitt slik i Fratello-artikkelen:

Ikke helt lett å forstå bakgrunnen for dette, kanskje rabatten på 10 % ikke er tilgjengelig for US...?

Kanskje tankegangen er at amerikanere må betale noe toll/mva på beløpet, mens det ikke er tilfelle innenfor EU, og så har YEMA helt glemt at ikke alle europeiske land er en del av EU, så da blir nordmannen sittende med svarteper...

Uansett. Blå og grå appellerte også mest til meg - forhåpentligvis er den så kul at de ekstra kronene er glemt i november

Uansett. Blå og grå appellerte også mest til meg - forhåpentligvis er den så kul at de ekstra kronene er glemt i november

hehe, tiden får vise. Jeg er spent på kvalitet, uansett så poster jeg noen bilder når den tid kommer.

Todda

Støttemedlem

- Medlem

- 14. mars 2013

- Innlegg

- 1.600

Ikke kjøpt, konkluderte med at det er noe annet som frister mer akkurat nå, men veldig kult at du har! Hvilken versjon gikk du for?

Høres ut som en snål praksis, men ser at prisen er oppgitt slik i Fratello-artikkelen:

Vis vedlegg 156218

Ikke helt lett å forstå bakgrunnen for dette, kanskje rabatten på 10 % ikke er tilgjengelig for US...?

Jeg gikk for Pepsi. Jeg fikk betale i dollar

.

Redigert:

Det var det jeg mistenkte, frekke jævler!

Det ender opp igjen med en prat med de.

Måtte du spesifisere ønsket valuta eller?

Todda

Støttemedlem

- Medlem

- 14. mars 2013

- Innlegg

- 1.600

Jeg fikk også først regning i euro. Etter en henvendelse skiftet de til dollar.

Nydelig IWC 3714. I samarbeid med Bucherer klokkebutikken har de kommet med en spesial utgivelse.

Link til artikkelen.

monochrome-watches.com

monochrome-watches.com

Link til artikkelen.

IWC Schaffhausen Portugieser Chronograph Bucherer BLUE IW371492 - Introducing (Specs & Price)

As part of its blue-themed special editions, watch retailer Bucherer unveils its latest model, the IWC Schaffhausen Portugieser Chronograph Bucherer BLUE.

chrbir

Støttemedlem

Kohe321

Støttemedlem

- Medlem

- 19. okt. 2011

- Innlegg

- 5.367

Kul ny modell fra Ball!

40mm kasse, 100m vanntett med skru-krone, 904L-stål.

Hmm, den gir meg sterke assosiasjoner til Tudor North Flag. Gangreserven var lekkert implementert på skiven her.

40mm kasse, 100m vanntett med skru-krone, 904L-stål.

Hmm, den gir meg sterke assosiasjoner til Tudor North Flag. Gangreserven var lekkert implementert på skiven her.

Kul ny modell fra Ball!

40mm kasse, 100m vanntett med skru-krone, 904L-stål.

Hmm, den gir meg sterke assosiasjoner til Tudor North Flag. Gangreserven var lekkert implementert på skiven her.

Helt klart noen forskjeller, men i tillegg til North Flag, gir den også ganske sterke assosiasjoner til Zenith Defy Classic, synes jeg. Like fullt, kul!

Del: