"You will own nothing, and be happy". Regner med Klaus Schwab allerede har gitt vekk alt han eier.

NEMLIG...

"You will own nothing, and be happy". Regner med Klaus Schwab allerede har gitt vekk alt han eier.

www.linkedin.com

www.linkedin.com

Jeg har aldri tatt de konspirasjonsteoriene om at vi styres av romvesner alvorlig selvfølgelig.

Vis vedlegg 240308

Men hvis Men in black filmene skulle trenge statister........

Stakkars Arne Hjeltenes, han er lei seg for at "staten og sosialistene" ikke vil la folk bli sjuke og dø for at han skal beholde bånnlinja.

https://www.nrk.no/ytring/lett-a-la-andre-ta-dugnaden-1.15433478

Kanskje han ikke skulle ha vært så redd for å betale skatt så hadde det vært litt mer for alle å dele på. Også hadde det sett mindre dumt ut når han gråter for sin syke mor i glasshus.

https://www.nettavisen.no/okonomi/rekordutbytte-for-arne-hjeltnes/s/12-95-3423818152

Ok , det var litt slemt mot Arne det her, men jeg er bare så lei av all sytinga fra kjendiser, idrettsfolk, næringslivet, musikere, skuespillere, prester, hytteeiere, svenskehandlere osv osv. Eneste som får fripass av meg er helsearbeidere og koronasjuke. Og meg selv da selvfølgelig, jeg må jo få syte over dem som syter!

Sjøl er jeg utrulig heldig og priviligert som har beholdt jobben og helsa det siste året.

Hva er alternativet? Hva blir konsekvensene for økonomien om dette fortsetter ett år til? Hva om dette fortsetter enda lenger?

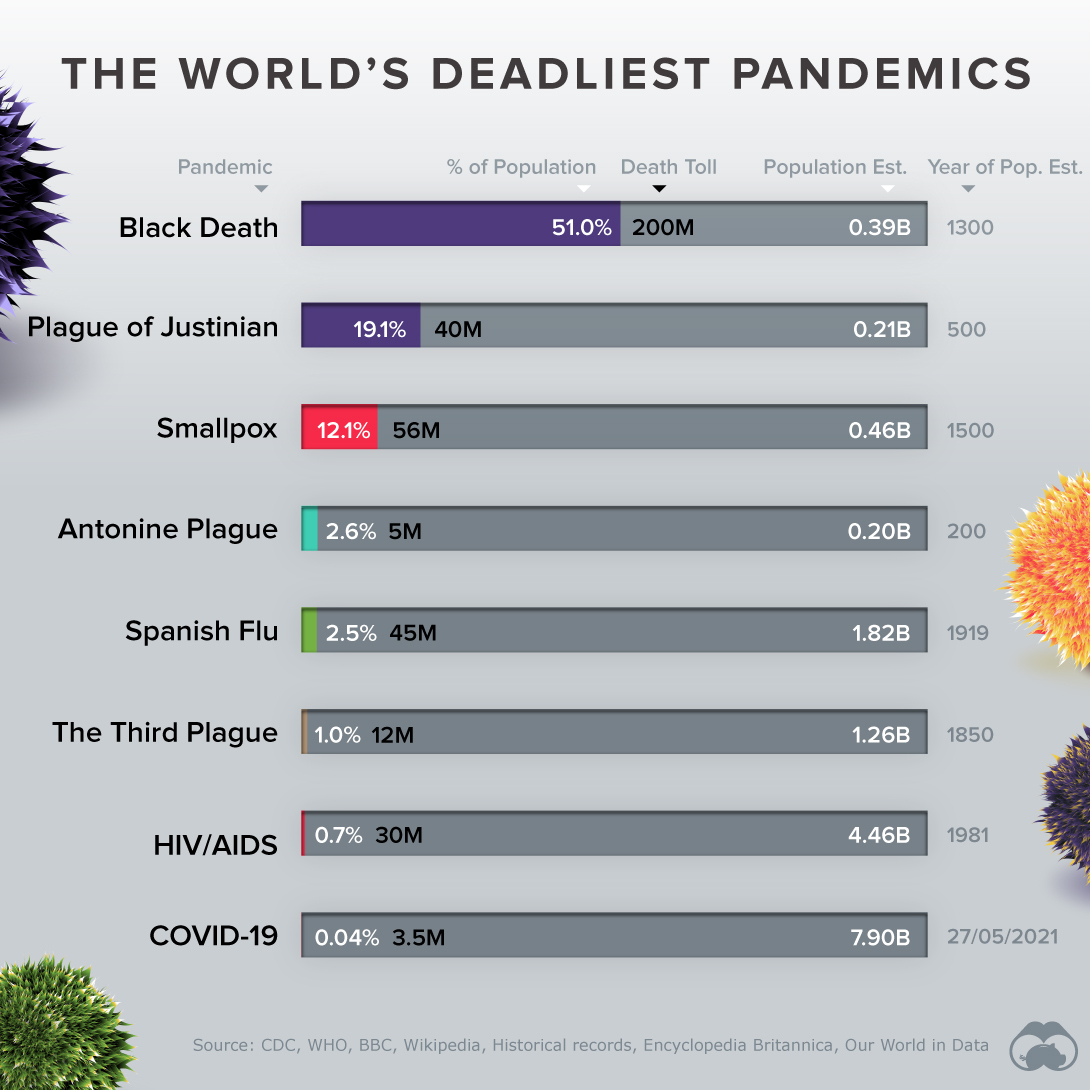

www.visualcapitalist.com

www.visualcapitalist.com

Jada Hammerfjord det er lett å finne tabeller og grafer, men å finne et alternativ som virker bedre enn nedstengning er verre.

Så igjen : Hva er alternativet? Hva blir konsekvensene for økonomien om dette fortsetter ett eller flere år?

Persisering: Jeg er ikke smittevernekspert, men jeg tenker så enkelt at smittsomme sykdomer ikke har mulighet til å spres hvis ikke syke mennesker møter andre. Siden vi ikke vet om vi har blitt syke må vi ha minst mulig kontakt med andre. Når en familie, by, fylke, land osv er uten smitte må vi hindre at smitte kommer tilbake. Det kan gjøres ved nedstengning, karantene eller testing.

Så hvis vi i sommer, når det nesten ikke var smitte i landet, hadde testet eller satt i karantene alle som krøssa grensa, hadde vi ikke hatt smitte nå. Har alle klagene vært med på å endre holdningene til smittevern? Jeg trur det.

En liten kommentar til det at nedstengning ikke har vært prøvd før. Før moderne medisin var vel nedstengning og karantene det eneste vi hadde som virka.